Ron’s Hawaii Ruse: A Technically Impossible Narrative Repeated for Four Years

In May 1996, Ron introduced a business concept initially branded Smartvision. A central claim in that pitch was that Hawaii was a natural global Internet hub because subsea fiber “surfaced” there and provided direct, lower-latency access to Asia.

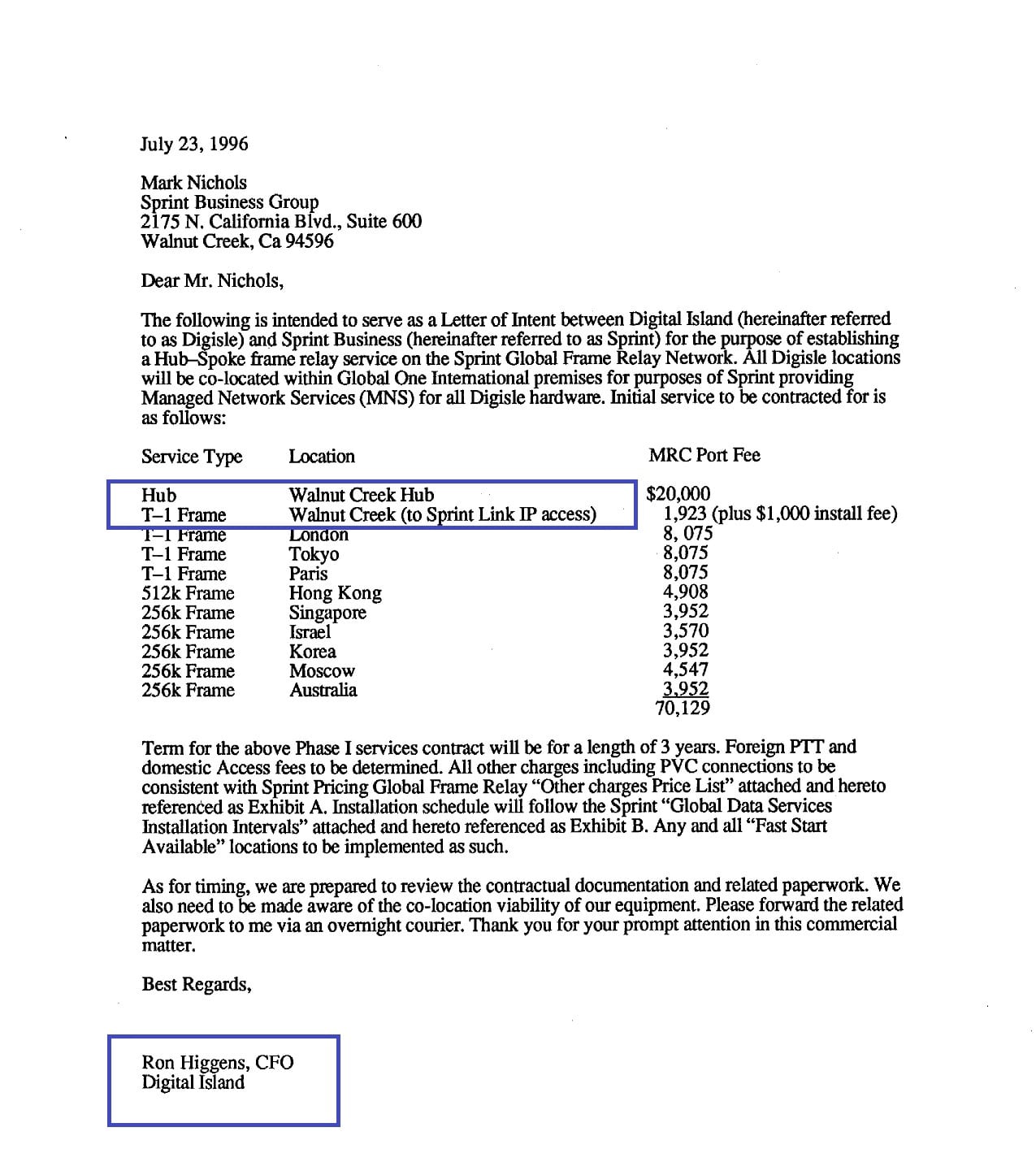

Within two weeks of hearing that claim, while I was still employed at Sprint, I asked Sprint engineering to verify the actual topology. Their answer was unambiguous: traffic originating in Hawaii routes east to the U.S. mainland and only then west across the Pacific on dedicated systems. There is no operational topology in which Hawaii serves as a westbound aggregation point to Asia.

In telecommunications, this is called “tromboning.” Hawaii telecom is a spur, not a gateway. It has never functioned as a general transpacific aggregation point for carrier backhaul into Asia.

This topology never existed, and I advised the team of these facts.

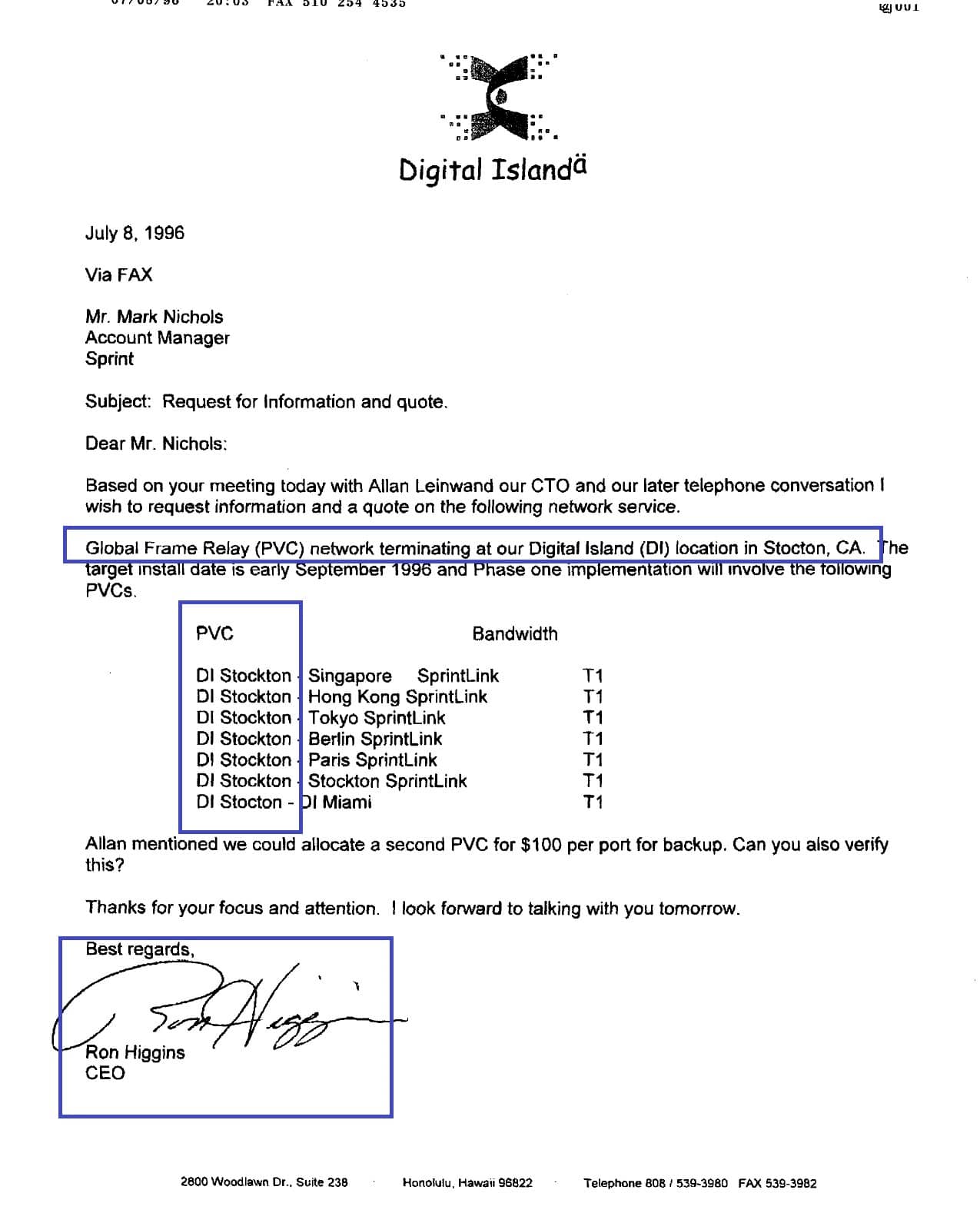

From June 1996 forward, I stated explicitly that Hawaii was never the value proposition. The value proposition was the service architecture and interconnection strategy executed from California, where carrier demarcations, peering points, and operational control actually exist.

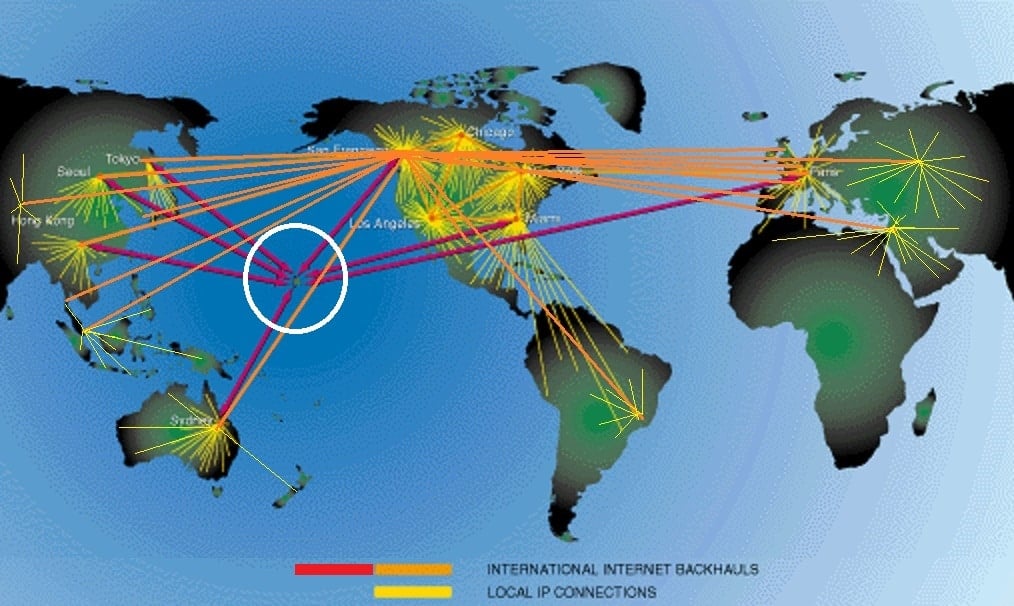

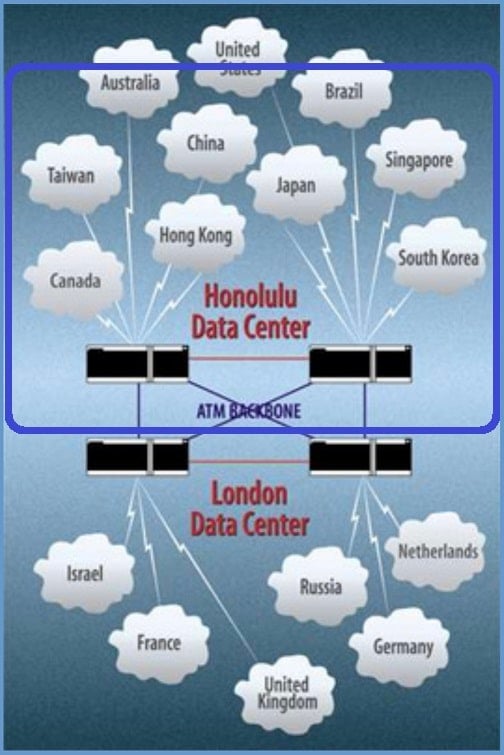

Despite the above, diagrams were circulated to investors and the media depicting Hawaii as a bidirectional hub with westbound links from Honolulu directly into Asia. Those links did not exist.

This was not a misunderstanding that was later corrected. It was a narrative that persisted after its falsity was known.

Exhibit Alignment

Exhibit A: Global Network Map With Hawaii Depicted as a Hub. This diagram depicts Hawaii as a bidirectional aggregation point with westward connectivity to Asia.

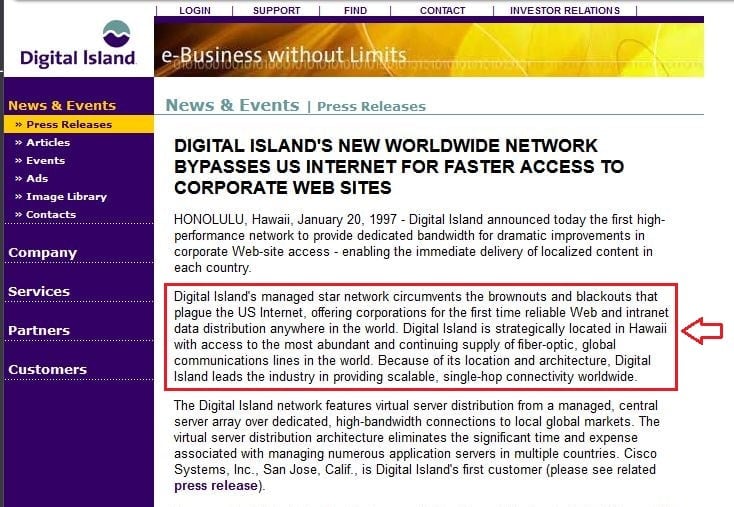

Exhibit B: This diagram places the Honolulu data center at the center of international backhaul, with direct links radiating into Asia, North America, and Europe. Those links did not exist as represented.

The Misrepresentation that Continued

Even after the topology issue was known internally, Ron and others continued to represent Hawaii as the Asia-direct hub, including language describing an “abundant supply of fiber bandwidth” that “surfaces from the Pacific” and provides access to “the most abundant and continuing supply of fiber-optic, global communication lines in the world.” Those statements were not grounded in the operational network we built.

Ron used these claims to assign technological and financial value to the Hawaii story. The diagrams and press statements misrepresented facts about the network’s topology and the role of Honolulu.

I publish this section for a single reason: to document a clear example of leadership-level misrepresentation, sustained over time, after correction, and in direct conflict with physical network reality.

What Ron Knew, and When

Documents from the period show that my recommendation was to hub in California, specifically Walnut Creek and Stockton, to stay closest to Tier 1 switching premises and actual carrier demarcations. Those same documents also show Ron presenting himself as both CEO and CFO, and Allan Leinwand being represented as the acting CTO at the time, even though the S-1 indicates Allan joined later, in February 1997.

Regardless, Ron ordered our Phase-1 global network with the hub in Hawaii and without my involvement. When the network was delivered and failed, exactly as I warned months earlier, I then re-ordered the entire replacement build to the Stanford University Data Center in Palo Alto.

This mattered because we already had the Cisco hosting contract in hand. This detour cost roughly four months of delivery time and delayed the revenue needed to support that contract. In addition, the network commitment was a five-year term, and using Hawaii as an “off-site” backup data center was senseless because I had acquired data centers in London and New York that we could have used instead. The Hawaii facility was a red herring that Ron wasted money, time, and engineering resources on.

Finally, an image used in 1999 is entirely untrue in depicting the Honolulu data center as having an ATM backbone to routes other than those demarcated through our California facilities. I know this as fact because I ordered the origin and destination of every circuit in our network.

Founding Timeline, Equity Representations, and the Documentary Record

This section exists to correct discrepancies between early employment representations, later equity outcomes, and the founding narrative presented in public and regulatory filings. Contemporaneous documents, operational reality, and later SEC disclosures diverge, and the record requires clarification.

Entry Date and Operational Role. On August 5, 1996, I joined Ron and Sanne Higgins to build what became Digital Island. At that time, the company had no operating network, no executed customer contracts, and no institutional funding. The work underway involved business formation, network architecture design, customer acquisition, and infrastructure planning.

Hawaii business registration for Digital Island was filed on September 6, 1996, approximately one month after I began performing these duties.

Equity Representations at Hiring. During early employment discussions in mid-1996, prior to the execution of any venture financing or the establishment of a formal option plan, I was told I would receive approximately three percent of the company. This representation was described using an early capitalization framework of roughly 2.5 to 3.0 million shares, with my allocation described as approximately 100,000 shares.

I was also told the CEO allocation would be approximately six percent. These representations occurred before the existence of a board-governed equity plan or the controls typically associated with venture-backed companies.

Operational Milestones Preceding SEC Filings

In November 1996, I negotiated and signed the Cisco Systems services agreement. That agreement was the first executed customer contract and the instrument that made the company financeable. Venture funding followed the execution of that contract.

Throughout late 1996 and 1997, I continued performing founder-level operational functions, including network architecture decisions, customer acquisition, infrastructure contracting, and financial modeling.

SEC Capitalization Disclosure

SEC Capitalization Disclosure. On April 26, 1999, the company filed its Form S-1 registration statement. That filing reports 27,870,736 shares outstanding, as converted, as of March 31, 1999.

The S-1 reflects the following equity positions: CEO 2,075,000 shares, representing approximately 7.4 percent; CTO 195,267 shares, less than one percent; CFO 83,000 shares, less than one percent.

My equity position at that time was approximately one one-thousandth of the company, materially inconsistent with the representations made at hiring and with the scope and duration of founder-level responsibilities performed.

Founding Narrative Framing in the S 1

Within less than thirty days from when the S-1 was filed, my employment contract was terminated. At that time, the company retained 20,000 shares of my unvested equity, including unvested portions associated with my CoFounding role representations and performance-based compensation.

This sequence matters because it fixes the public record at the point of filing while foreclosing further participation in equity outcomes tied to earlier contributions.

Founding Narrative Framing in the S1

The S-1 states that the company did not begin offering its Global IP Applications Network services until January 1997 and characterizes prior activities as unrelated to current operations.

This framing conflicts with documentary evidence of customer contracting, network design, and infrastructure work performed in 1996, including the Cisco Systems agreement executed in November 1996.

Where early operational reality is minimized in formal filings, the individuals responsible for that work are similarly minimized in the historical record.

Summary of Discrepancy

The record reflects a divergence among three elements: early employment and equity representations, founder-level operational contributions performed before and during the initial build, and equity ownership and founding attribution presented in SEC disclosures.

This section does not assert intent or motive. It documents outcomes and discrepancies based on contemporaneous documents and public filings.

The purpose is record correction.

Paper trail

[1] Employment offer letter (Aug 5, 1996): https://marknichols.com/employment-agreement-8-5-1996/

[2] Hawaii business registration filing (Sep 6, 1996): https://marknichols.com/business-registration-9-6-1996/

[3] Cisco services agreement (Nov 1996): https://marknichols.com/cisco/

[4] Digital Island Form S-1 (filed Apr 26, 1999): https://www.sec.gov/Archives/edgar/data/1084329/0001012870-99-001268.txt